Business in Saudi Arabia strikingly more optimistic now

Businesses in Saudi Arabia are significantly more optimistic about revenue growth and business opportunities than last year, as the Vision 2030 reforms set by Crown Prince Mohammed Bin Salman look to increase private sector participation. The EY Growth Barometer, an annual survey of entrepreneurs’ and middle-market leaders’ growth strategies, revealed that 33% of middle-market businesses in Saudi Arabia anticipate over 10% growth this year, and six in ten are targeting a growth of 6-10%, a 24-percentage point jump compared to the results of last year’s survey.

This year, regulation has emerged as a new force in stimulating innovation and revenue growth. In a major shift in opinion, over one third (35%) of Saudi respondents regard regulation as the top driver of innovation, up 28 percentage points compared to last year.

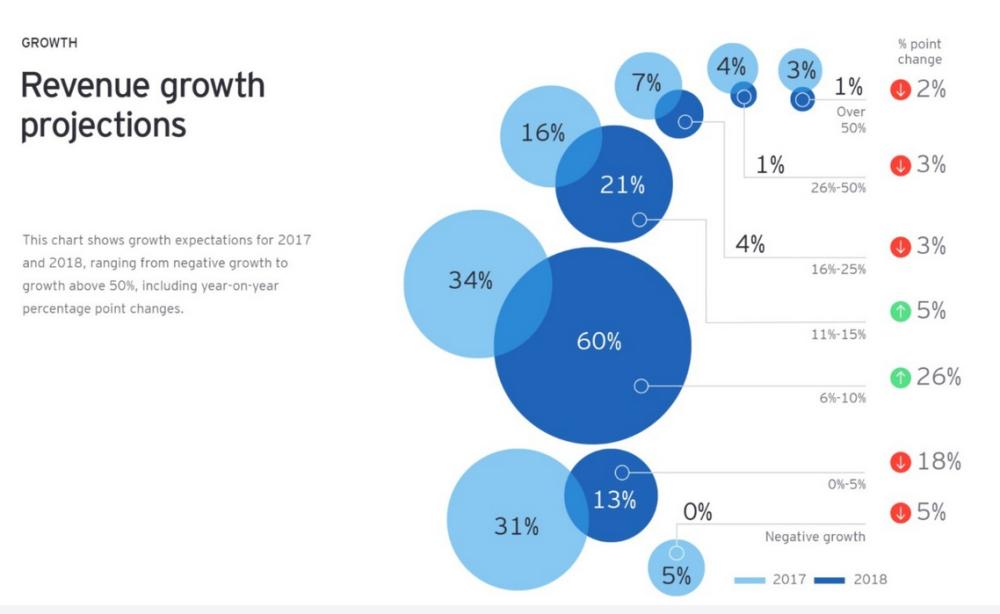

Meanwhile, global confidence has strengthened in the last 12 months, with nearly six out of ten respondents (60%) targeting high single digit growth (6%-10%). This represents a 26 percentage point increase on 2017. Furthermore, this year just six of over 2,700 respondents are looking at negative growth (compared to 5% last year). More than one in four companies (27%) plan double-digit growth (marginally down from 2017, when 30% of companies were in this high growth band).

Fahad Altoaimi, Saudi Arabia Managing Partner, EY, said: “Company leaders of middle-market companies in Saudi Arabia are riding a wave of ambition and confidence, as set out by Vision 2030 and the National Transformation Program. Contrary to the common belief that regulation stifles growth and innovation, Saudi executives believe that reforms set by the Crown Prince have been driving change and growth in the Kingdom. The decision of MSCI to add Saudi Arabia to its Emerging Markets Index is a testament to the progress being made in the Kingdom and the positive effects of the reforms.”

“The ambitious growth expectations of Saudi middle market companies cited in the EY Growth Barometer far outstrip the International Monetary Fund’s 2018 GDP growth forecast of 1.7%. This is very encouraging for Saudi businesses - one of the key goals of Vision 2030 was to increase participation from middle-market businesses in the economy, and this has clearly boosted confidence,” Fahad noted.

While executives remain confident in growth, they are concerned about cash flow shortages, citing insufficient cash flow as the number one challenge to growth this year. Approximately a third (34%) of Saudi companies surveyed currently rely on bank finance for funding, but as Saudi Arabia looks to upgrade its stock exchange and open it to foreign investors, are looking for funding through capital markets. Almost three-quarters (73%) of executives are considering an IPO – another sign of burgeoning business confidence.

Abdulrahman Moulay Albizioui, Saudi Arabia Transaction Advisory Services Leader, EY, said:

“Cash flow is one of the highest risks for companies on a growth journey. With growth comes the need for working capital, and in line with fast-growth companies worldwide, the gap between long-term financing and short-term needs is a constant challenge. Growth strategies such as technology investment, entry into new sectors and sub–sectors, and new markets, all put a strain on working capital. Lack of cash in the balance sheet is a significant challenge to growth not just in Saudi Arabia, but across the world.”

Attitudes toward new technology have evolved rapidly since last year’s survey. In 2017, 94% of Saudi respondents to the EY Growth Barometer said that they would never adopt robotic process automation. By 2020, 82% say they will have adopted AI and implemented robotic process automation, with 95% of respondents intending to do so within the next five years.

“While Saudi Arabian companies are at different stages of AI adoption, executives now no longer doubt its critical role in the future and have a new urgency to embrace AI and the business transformation that comes with its implementation,” Abdulrahman explained.

According to the EY survey, Saudi Arabian business leaders see the need to expand their geographic footprint beyond home borders if they are to become market leaders in their space. Overseas expansion is the leading growth priority for 29% of respondents, while 18% of middle-market businesses are aiming to grow at home.

Buoyed by confident revenue growth targets, Saudi Arabian business leaders are on a hiring spree with 58% looking to recruit more full-time staff. The greatest talent need, however, is more diversity, cited by 62% of Saudi Arabian respondents.

“Saudi leaders have put diversity at the top of their recruitment agendas and this emphasis is likely to be a result of the National Transformation Program 2020 and Saudi Vision 2030. Furthermore, the expansion into overseas markets, building external alliances, and investing in technologies to meet high growth targets will continue to drive the GDP growth of the country for years to come,” Abdulrahman said.

Andy Baldwin, EY Area Managing Partner for Europe, Middle East, India and Africa (EMEIA), said "continental Europe sees the strongest growth sentiment for a decade both domestically and export-led, and we see this confidence reflected in foreign direct investment into the region. Moreover, Europe has moved beyond Brexit. It is now a localized UK issue, weighing on business confidence, but not impacting continental Europe."

In 2017, foreign direct investment (FDI) projects in the UK declined by 6 percentage points over 2016, now overshadowed by Brexit, and leaving Germany in pole position. A surging France (up 31 percentage points) is now a much fiercer competitor. “In Europe, the historic growth of inward investment to the longstanding league champion, the UK, has stalled,” said Baldwin.

The cohort of companies expecting to grow at the highest rates (from 15% to over 50% in the current year) share some characteristics that mark them out from the broad survey base of all respondents.

While women lead 4% of companies we surveyed overall, they lead 17% of companies with the highest growth ambitions.

For companies targeting growth rates over 15% nearly one in four (23%) operate in the technology sector, while one in six (15%) is US-based, just over one in ten (11%) are based in India and just under one in ten (9%) are UK-based.

More than one in four (27%) of this elite group of high-growth entrepreneurs – including some past winners of the EY Entrepreneur Of The Year program – are focused on entry into new overseas markets as their number one growth priority, compared to 23% of the broader cohort.